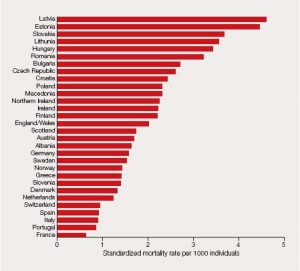

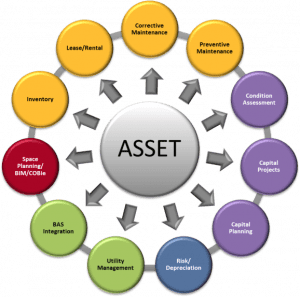

For example, due to rapid technological advancements, a straight line depreciation method may not be suitable for an asset such as a computer. A computer would face larger depreciation expenses in its early useful life and smaller depreciation expenses in the later periods of its useful life, due to the quick obsolescence of older technology. It would be inaccurate to assume a computer would incur the same depreciation expense over its entire useful life.

Types of Depreciation With Calculation Examples

But the Internal Revenue Servicc (IRS) states that when depreciating assets, companies must generally spread the cost out over time. (In some instances they can take it all in the first year, under Section 179 of the tax code.) The IRS also has requirements for the types of assets that qualify. Accumulated depreciation is the total amount of depreciation of a company’s cost of goods sold (cogs) calculating assets, while depreciation expense is the amount that has been depreciated for a single period. Depreciation is an accounting entry that represents the reduction of an asset’s cost over its useful life. By including depreciation in your accounting records, your business can ensure that it records the right profit on the balance sheet and income statement.

You’re our first priority.Every time.

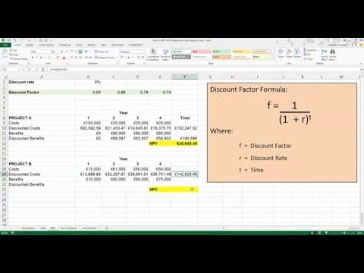

Note that for purposes of simplicity, we are only projecting the incremental new capex. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, https://www.wave-accounting.net/ and innovator in teaching accounting online. This entry indicates that the account Depreciation Expense is being debited for $10,000 and the account Accumulated Depreciation is being credited for $10,000.

Do you own a business?

She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business. Subtract salvage value from asset cost to get the total value that this asset will provide you over its lifespan. In turn, depreciation can be projected as a percentage of Capex (or as a percentage of revenue, with depreciation as an % of Capex calculated separately as a sanity check).

- The declining balance method is a type of accelerated depreciation used to write off depreciation costs earlier in an asset’s life and to minimize tax exposure.

- Under the double-declining balance method, the book value of the trailer after three years would be $51,200 and the gain on a sale at $80,000 would be $28,800, recorded on the income statement—a large one-time boost.

- In a full depreciation schedule, the depreciation for old PP&E and new PP&E would need to be separated and added together.

- Theoretically, this makes sense because the gains and losses from assets sold before and after the composite life will average themselves out.

“The depreciation deduction is typically the original value of the asset divided by the asset’s effective life.” “Depreciation for tax purposes is a deduction for the decline in value of an asset,” explains Gavan Ord, a spokesperson for CPA Australia. In other words, depreciation spreads out the cost of an asset over the years, allocating how much of the asset that has been used up in a year, until the asset is obsolete or no longer in use. Without depreciation, a company would incur the entire cost of an asset in the year of the purchase, which could negatively impact profitability. Analysts and investors in the energy sector should be aware of this expense and how it relates to cash flow and capital expenditure. Depreciation refers to the loss in value of an asset over a period of time due to usage, passage of time and obsolescence.

Those include features that add value to the property and are expected to last longer than a year. For the sake of this example, the number of hours used each year under the units of production is randomized. So, even though you wrote off $2,000 in the first year, by the second year, you’re only writing off $1,600.

This deduction relies on claiming annual depreciation—since you can’t claim the full depreciation amount all in one year, you’ll lose out on potential tax benefits. Software makes it easy to track and calculate the depreciation of your small business assets. Track your mileage for vehicles with the mileage tracking app, organize your assets to measure depreciation, and make tax https://www.business-accounting.net/journal-entry-for-depreciation-depreciation/ season a breeze with automated financial report generation. After an asset is purchased, a company determines its useful life and salvage value (if any). In effect, this accounting treatment “smooths out” the company’s income statement so that rather than showing the $100k expense entirely this year, that outflow is effectively being spread out over 5 years as depreciation.

The purchase price of an asset is its cost plus all other expenses paid to acquire and prepare the asset to ensure it is ready for use. The expenditure on the purchase of machinery is not regarded as part of the cost of the period; instead, it is shown as an asset in the balance sheet. For example, a company often must often treat depreciation and amortization as non-cash transactions when preparing their statement of cash flow.

The assumption behind accelerated depreciation is that the fixed asset drops more of its value in the earlier stages of its lifecycle, allowing for more deductions earlier on. The depreciation expense, despite being a non-cash item, will be recognized and embedded within either the cost of goods sold (COGS) or the operating expenses line on the income statement. The units of production method recognizes depreciation based on the perceived usage (“wear and tear”) of the fixed asset (PP&E).

The definition of depreciate is to diminish in value over a period of time. An amortization schedule is often used to calculate a series of loan payments consisting of both principal and interest in each payment, as in the case of a mortgage. As a loan is an intangible item, amortization is the reduction in the carrying value of the balance. Salvage value can be based on past history of similar assets, a professional appraisal, or a percentage estimate of the value of the asset at the end of its useful life. DAP Pricing– Unless otherwise stated, all prices are shown as Manufacturer’s Recommended List Price (MRLP) inclusive of GST, exclusive of options and on road costs.